When it comes to scalping, simplicity often leads to better execution. One of the easiest strategies I've recently discovered is something that I’ve been referring to as High Volume Candles (HVC). I’ve been looking all over to see if there is anyone else talking about similar concepts but so far I haven’t found anything. All I know is that it’s been working for me and for that reason it has become one of my go-to scalping setups.

It's a pretty straightforward method that leverages high-volume candles as entry points during impulsive market conditions. If you're like me—preferring quick trades without overcomplicating your chart—this might be just what you’re looking for.

Quick Intro into Volume Price Analysis

Volume Price Analysis (VPA), as taught by Anna Coulling, is a method of understanding market behavior by analyzing the relationship between price action and volume. The premise is simple: price movement on its own is incomplete without understanding the underlying volume driving it. By combining the two, traders can identify the market's true intentions and gain insight into future price movements.

There are two main points to understand regarding Volume:

Volume Validates Price

Volume acts as a confirmation tool for price action. If a price move occurs with significant volume, it suggests strong market sentiment. Conversely, a move with low volume might indicate weakness or a lack of conviction.Anomalies = Opportunities

When price action and volume diverge (e.g., a strong price move on low volume), it often signals manipulation or an unsustainable move, providing potential trading opportunities.

For this strategy, we’re only going to pay attention to number one, Volume Validates Price.

My Theory of High Volume Candles

Big candles, with big volume are good indicators that someone with deep pockets just entered the market. Remember, volume validates price. That being said, often times when large players enter the market, they have to break their orders up into smaller chunks. Identifying a level (high volume candle) where large players are getting involved can give you a heads up to where they are more likely to get involved again in the future, potentially to fill more of their orders.

How the Strategy Works

Here’s a step-by-step breakdown:

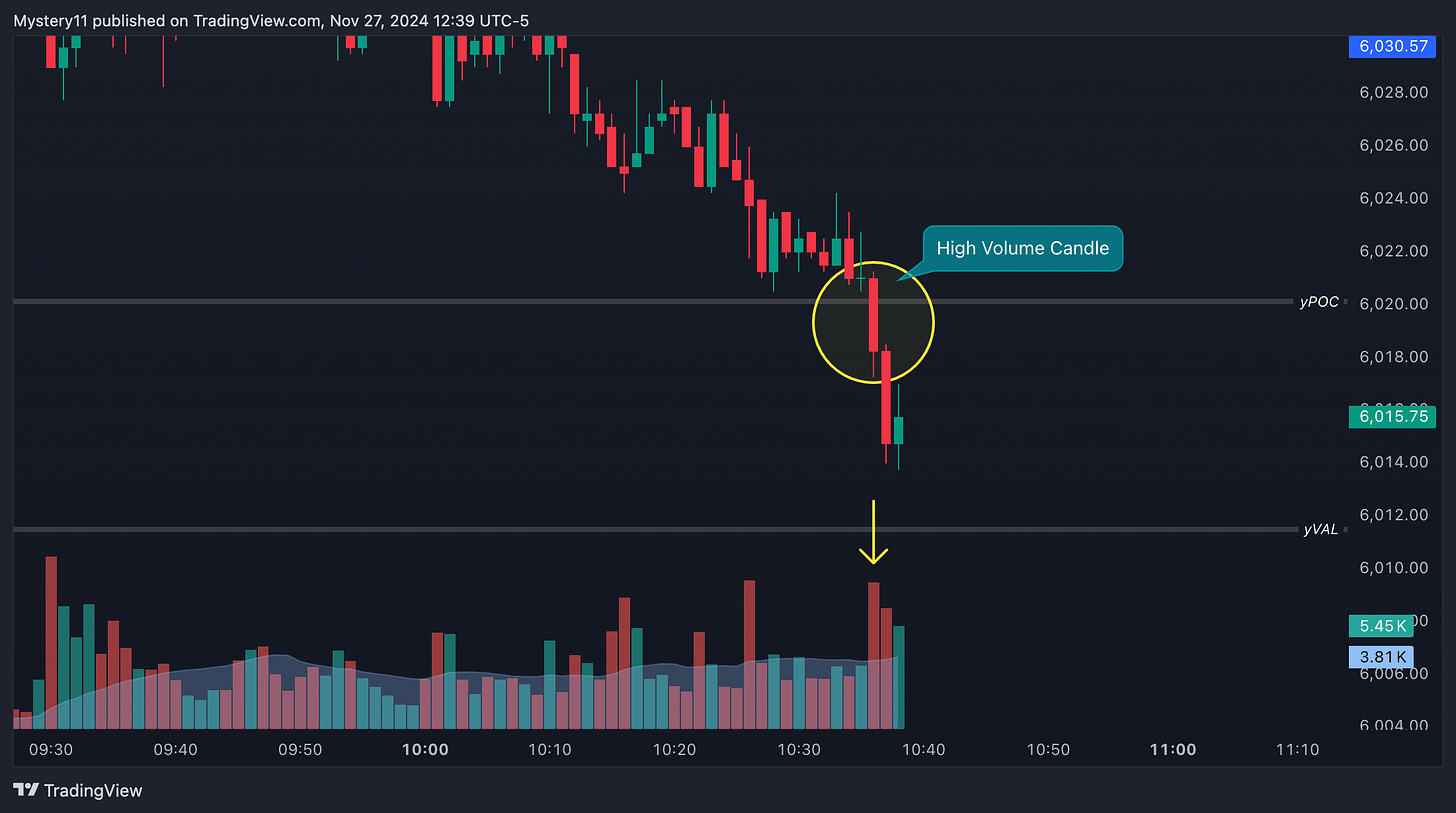

Identify Market Conditions

First, ensure the market is in an impulsive move—either displacing upward or downward. I look for this on the 1-minute chart.Look for a High Volume Candle (HVC)

On the 1-minute chart, look for candles with noticeably higher volume than their neighbors. These are the HVCs, and they often indicate areas of strong institutional activity or significant participation.Wait for the Retracement

Once you’ve identified a HVC, wait for price to return to that candle. This retracement is where we’ll look to enter the trade.

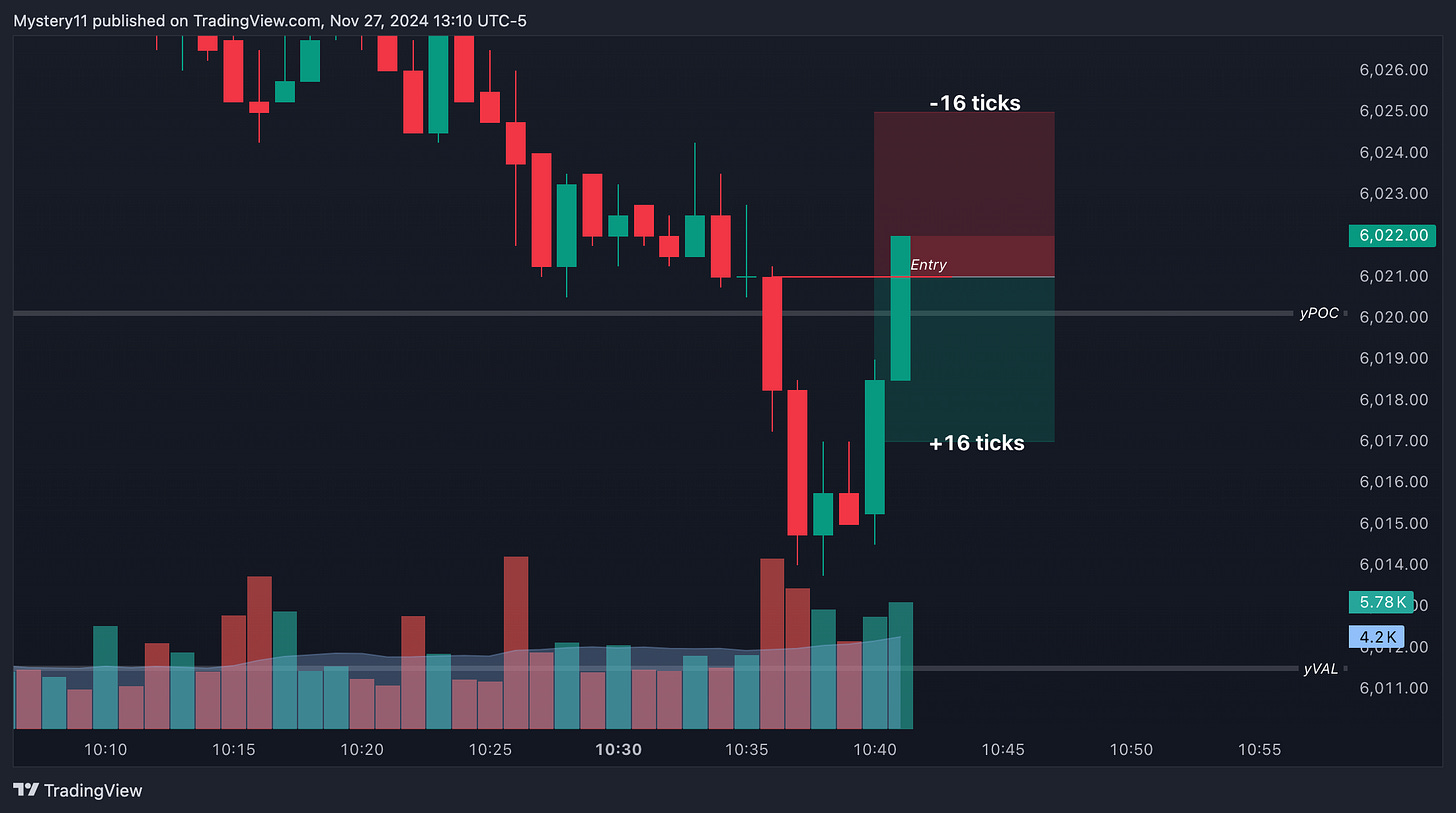

(Tip: The best candles will be the HVC’s that line up with another important level on your chart; VWAP, Point of Control, etc.)Enter the Trade

Wait for price to retrace to the opening price of the HVC and enter in the direction of the lower time frame trend. This ensures you’re trading with momentum, not against it.Stop-loss

Before price gets to entry, use the measuring tool to measure the size of the HVC, in ticks. Use that as your stop-loss, above or below entry. In this example, the HVC measures 16 ticks therefore you will place your stop-loss 16 ticks away from entry.Take Profit

Target a 1-to-1, using the same ticks as your stop-loss. This means if your stop-loss is 16 ticks, target 16 ticks.

(Tip: Sometimes you’ll find a HVC that will give you a 30+ tick stop-loss. In that scenario, I’ll usually keep my SL and TP to 20 ticks)

Final Thoughts

As with any strategy, discretion, experience, and context all matter here. Not every HVC is going to be a winner so don’t go trading every HVC you see. As mentioned the best HVC’s tend to be the ones that line up with another significant level. My favorites (as of now) are VWAP, or the 8 EMA or the 24 EMA.

I’d recommend adding your own spin on it and see how it performs. That being said, this is still very much a work in progress for me so treat all of this with a grain of salt.

Hopefully you’re able to find some results of your own — let me know if you have any success!