I’m sure we’ve all heard the phrase “market structure is king” - and if you haven’t, then I’m here to tell you just that.

There are so many different strategies you can employ when it comes to trading, but in my honest opinion, if there was one strategy to rule them all - it would be market structure.

I can’t stress this enough. If all you knew was market structure then you’d be set. No need for indicators, footprint charts, TPO charts, literally, nothing.

Learning complex market structure changed everything for me. I found my mojo, I started hitting 10RR trades regularly, my PnL started climbing, but most of all, for the first time ever, I was able to trade without fear.

If there are two things you take away from this article, let those two be the following:

Market structure is everything

You need to learn how to trade without emotions

For now, let’s focus on number one.

Rant over, let’s get started.

What is a “run”?

A run is a sustained move in any given direction (up or down). A run has two characteristics; impulsive and/or corrective, depending on the trend.

What is a “trend”?

A trend is made up of a series of runs. There are two characteristics of a trend: uptrend and/or downtrend.

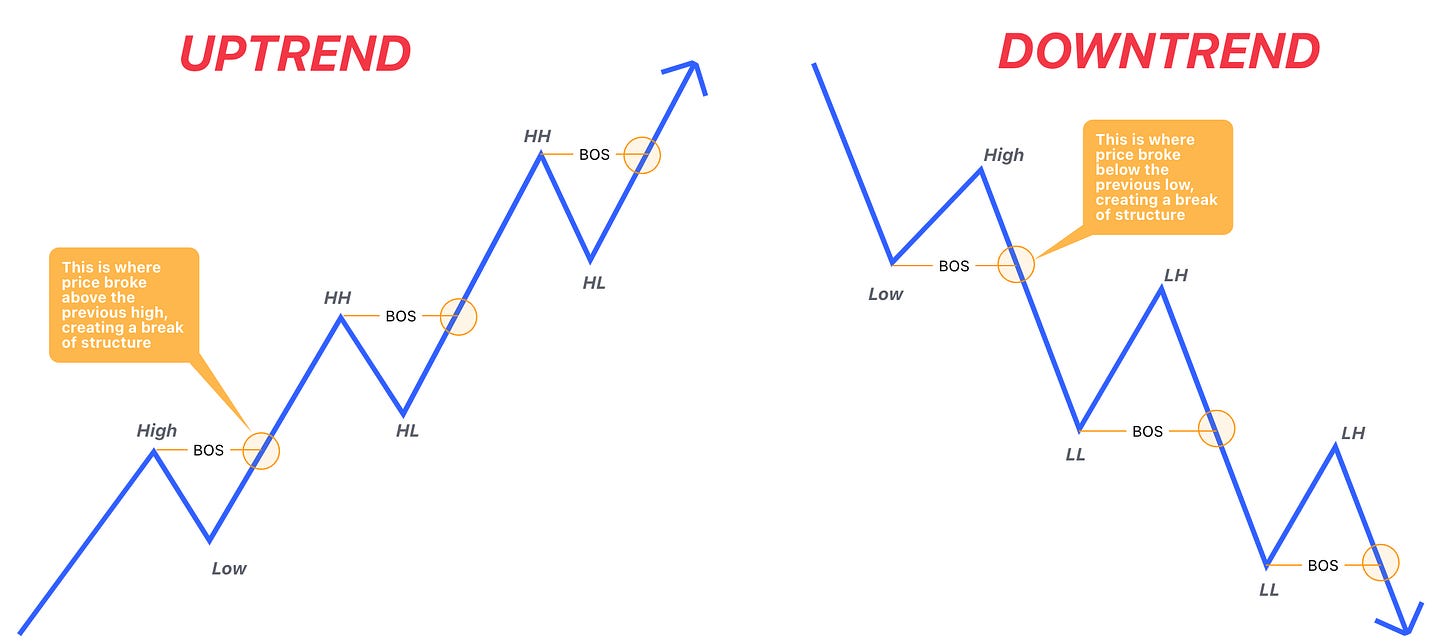

An uptrend is defined as a series of higher highs and higher lows, while a downtrend is defined as a series of lower highs and lower lows.

NOTE: higher lows or lower highs are not confirmed until a break of structure.

What is a “break of structure”?

A break of structure (BOS) is defined as a break of a swing high or a swing low. For example, during an uptrend, in order for price to make a new higher high, it must break the previous high. The opposite is true during a downtrend - in order for price to make the new lower low, it must break past the previous low.

What is a Swing Low/ Swing High?

Uptrend

During an uptrend, a swing low is confirmed only after a break of the previous high (BOS). After price breaks above the previous high, look for the lowest point between the previous high and the break of structure, this is now the confirmed Swing Low.

Downtrend

During a downtrend, a swing high is confirmed only after a break of the previous low (BOS). After price breaks below the previous low, look for the highest point between the previous low and the break of structure, this is now the confirmed Swing High.

Weak highs & lows VS. Strong highs & lows

A swing low has one job; to create a new swing high.

A swing high also has one job; to create a new swing low.

It is important for you to memorize the above statement because this is when you will start to acquire a sense of direction for price action.

Uptrend

By nature, an uptrend is a series of higher highs and higher lows - meaning that price is consistently breaking structure to the upside in order for the next high to be established.

Now let’s add the above statement to our definition of an uptrend: a swing low’s job is to create a new swing high and a swing high’s job is to create a new swing low.

If you haven’t noticed already, during an uptrend, price is consistently taking out the highs, while the lows are remaining intact. Because of this, you can now assume that during an uptrend, the lows are strong while the highs are weak. For an uptrend to hold true, highs are expected to be broken while the lows are expected to hold.

Downtrend

The opposite is now true during a downtrend. High’s are expected to hold while the lows are expected to break, thus adding to our definition; during a downtrend, highs are strong while the lows are seen as weak.

I recommend that you read through this article a minimum of three times. Once with out notes, a second time writing out your own notes on each topic, putting everything into your own words, including diagrams, and a third time to really engrain these concepts.

Again, to reiterate - this is just the beginning. I am going to expand further on each of these topics and explain how you can develop a mechanical system utilizing these concepts.

Without understanding the basics of market structure nothing else will make sense. Please take your time with this stuff. Do not rush the process. I recommend taking some time away from trading while you’re digesting these new concepts. If you have any questions at all, please do not hesitate to leave a comment below.

Mr. E