Premium vs. Discount Zones: Part One

Click here to upgrade your subscription and watch the video version of this lesson.

Everyone loves a sale.

Furthermore, everyone wants to feel like they are getting a good deal. Whether its buying a house, a car, or even buying pineapple, a deal is a deal.

The same is true for banks and large corporations. When Walmart is buying supplies, they are going to look for the lowest possible prices so that they can resell those same products at a higher price in order to turn a profit.

I’m sure you’ve heard of the old saying, “buy low, sell high”

Businesses manage their stocks using this same principle — buy when prices are low, sell when prices are high.

The question you should now be asking yourself is; how does one know when prices are low versus when prices are high?

Or in other words, when is a good time to buy vs. when is a good time to sell?

The answer to that question can be found through identifying premium and discount zones within a swing range.

By now you should know how to identify swing ranges, and if not, then please read my how-to-guide or upgrade your subscription to watch the video tutorial.

Once you have identified the swing range you are trading within, use the Fibonacci Retracement tool in order to find the premium and discount zones within the swing range.

Use the settings below:

As a rule of thumb — anything above the 50% fib line is known as the Premium Price Zone. Anything below the 50% fib line is known as the Discount Price Zone.

When applying this to your chart, drag the fib tool from Swing Low to Swing High, or vice versa, depending on the trend. As shown below:

Why is this important?

By understanding where the premium and discount zones are within the swing range, you can now determine the best areas to buy and/ or sell.

Longs are higher probability in the discount zone of a swing range

Shorts are higher probability in the premium zone of a swing range

When price action is in an uptrend, it’s best to wait for price to reach the discount zone before looking for longs or buying

When price action is in a downtrend, it’s best to wait for price to reach the premium zone before looking for shorts or selling

Here are a few examples:

In an uptrend your best opportunity to long is going to be below the 50% fib line within the swing range, aka the discount zone.

In a downtrend your best opportunity to short is going to be above the 50% fib line within the swing range, aka the premium zone.

Using Premium & Discount Zones In Your Trading Plans

As mentioned in the Mechanical Market Structure Guide, once you have identified your swing range, you can now start to predict future price action based on the objective of the swing range.

Let me refresh your memory:

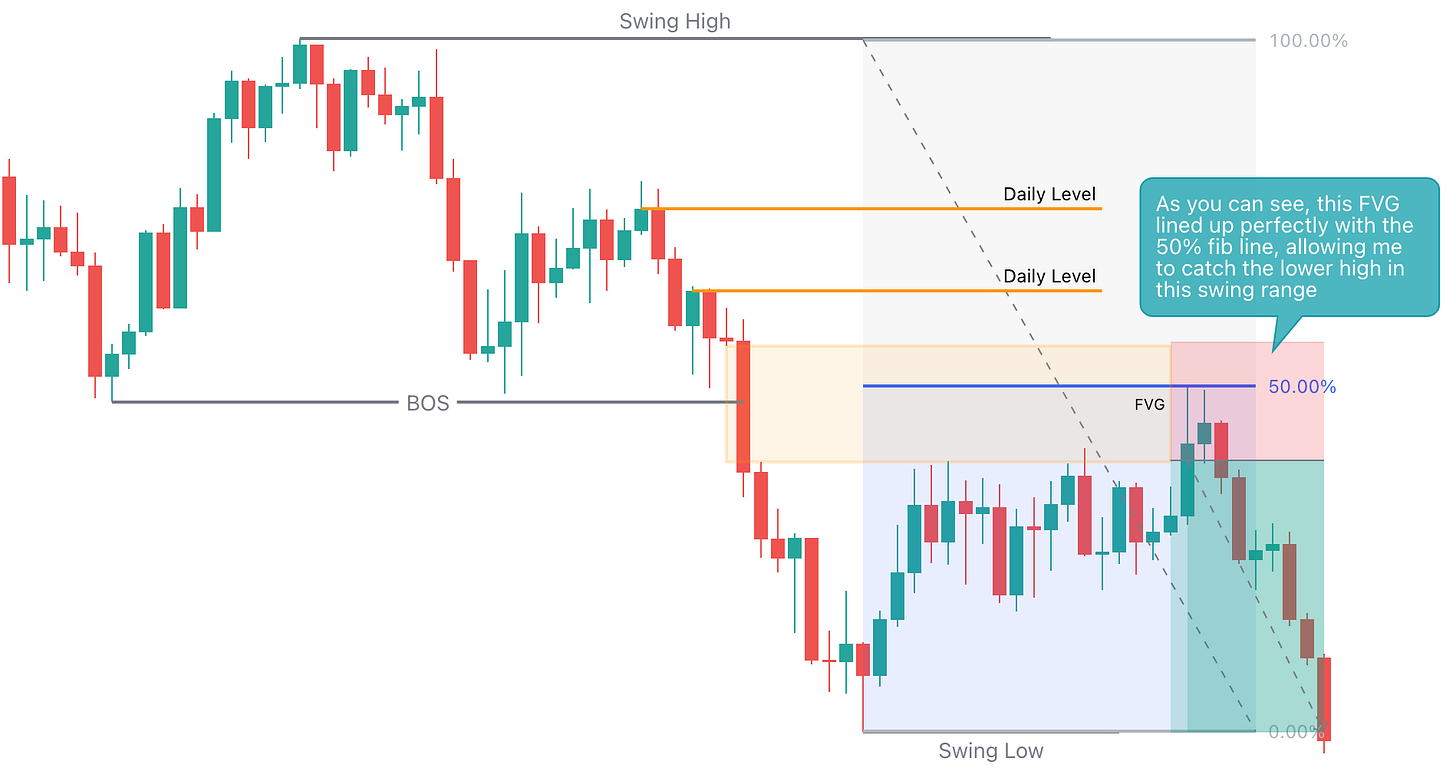

After a bearish break of structure in a downtrend, the objective of a swing range is to create a lower high

After a bullish break of structure in an uptrend, the objective of a swing range is to create a higher low

By introducing premium and discount zones to your swing range, you can now begin to identify the exact area(s) where the higher low or lower high should form.

After a bearish break of structure in a downtrend, the objective of the swing range is to create a lower high. The highest probability area for the lower high to form is going to be in the Premium Price Zone of the swing range (above the 50% fib line)

After a bullish break of structure in an uptrend, the objective of the swing range is to create a higher low. The highest probability area for the higher low to form is going to be in the Discount Price Zone of the swing range (below the 50% fib line)

Let me show you what this looks like:

Now that you know how to identify exactly where a higher low or lower high is expected to form within a swing range, you can now begin to look for areas of support or resistance within the premium/ discount zones in order to catch the higher low/ lower high.

In other words, imagine that price is a downtrend — after a bearish BOS, price starts to pull back. After identifying the swing range, you are expecting price to form a lower high somewhere within the premium zone of the swing range. Using this information, you can now start looking for areas of resistance within the premium zone that could lead to the formation of the lower high. See below:

Here’s another example:

Imagine price is in an uptrend — after a bullish BOS, price starts to pull back. After identifying the swing range, you are expecting price to form a higher low somewhere within the discount zone of the swing range. Using this information, you can now start looking for areas of support within the discount zone that could lead to the formation of the higher low. See below:

Voilà, there you have it. This concludes part one of premium vs. discount zones.

In summary, premium and discount zones should be used in order to identify the highest probability areas of a swing range where you expect price to form a higher lower or lower high.

Want more? Click here to upgrade your subscription and watch the video tutorial of Premium vs. Discount Zones [Part one]

In part two, I will be going into more advanced concepts of premium vs discount zones and how to confirm a strong break of structure vs. a weak break of structure and how this idea ties into the formation of liquidity zones.

Thank you for reading!

Mr. E