Let me introduce you to [in my opinion] the most underrated chart pattern in all of trading - The Quasimodo Pattern.

The Quasimodo is a type of malformed head-and-shoulders pattern that gets its name from Victor Hugo’s hunchback character of the same name. It has also been called the Over-Under pattern.

This pattern alone can identify high probability reversals for scalping, day trading, and even swing trading, making this a unique pattern to look for across all time frames.

Before we get started, here is your Quasimodo cheat sheet:

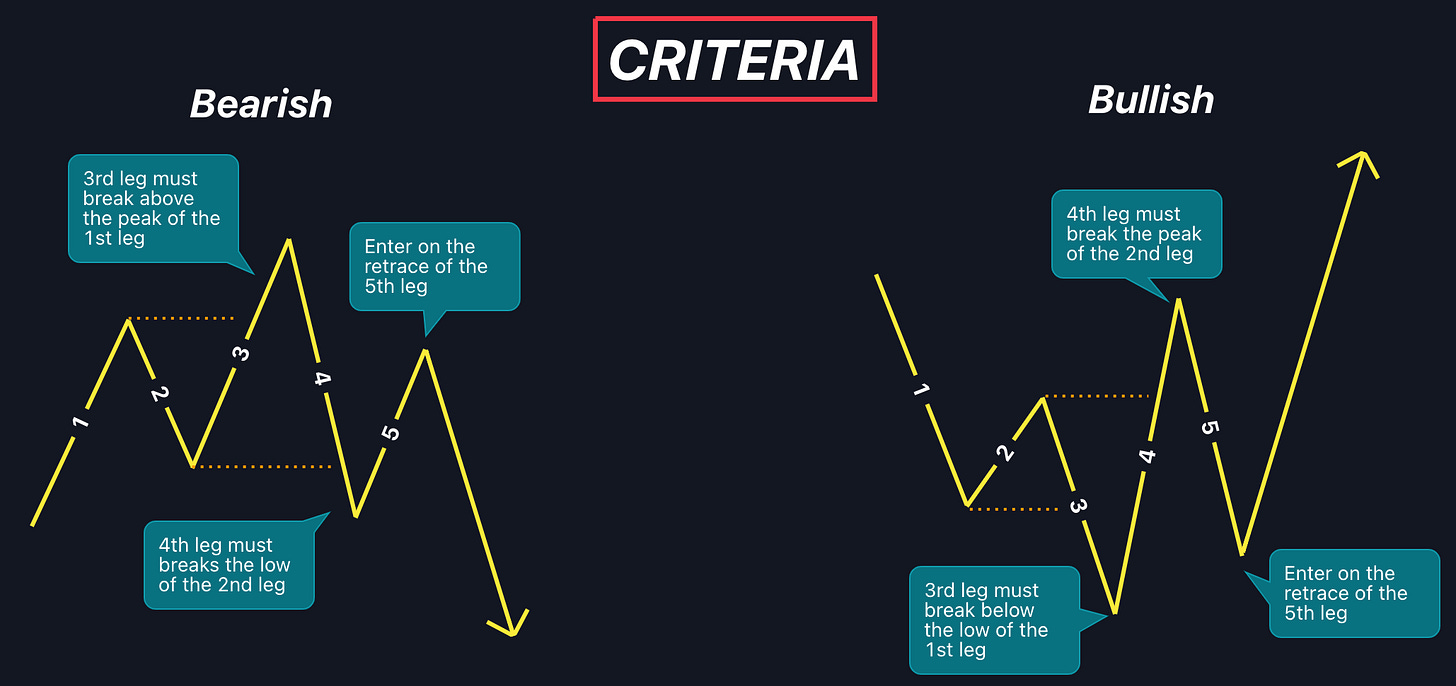

A bullish Quasimodo will be found at the end of every downtrend

A bearish Quasimodo will be found at the end of every uptrend

There are four main legs to a Quasimodo pattern

The fifth leg is your entry

This pattern alone is the basis of 95% of my trading strategy. Let me say that again - nearly my entire trading strategy is based off of this one pattern.

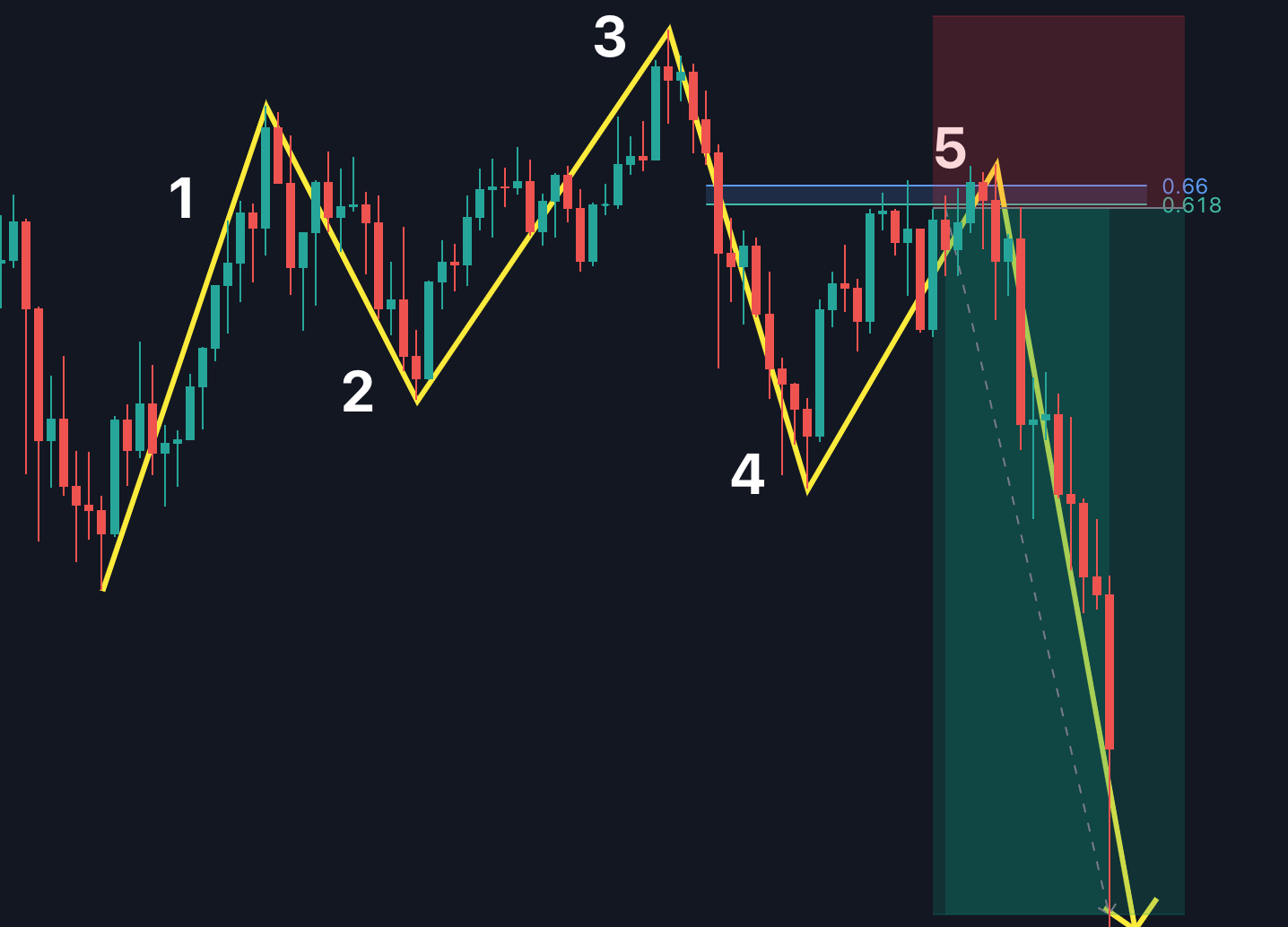

I highly recommend that you train your eyes at being able to spot this pattern across all timeframes. Here are a few examples of the Quasimodo pattern in real market conditions:

How to trade the Quasimodo pattern

Here is the exact criteria I look for when trading the Quasimodo pattern as well as my entry tiggers and targets. This part is very important so take your own notes, print out these info graphics, or do whatever you need to do to help you memorize this part:

How to use the Quasimodo pattern in your trading

Paired with the right confluence and context, adding the Quasimodo pattern to your strategy can take your trading to the next level. Here is how I use the Quasimodo Pattern in my trading:

Step One: Identify a support/ resistance level you want to trade from. This can be anything from S/R levels, Order blocks, VWAP, nPOCs, Daily horizontals levels, pDay Value Areas, Fibonacci levels, you name it.

Step Two: Be patient and wait for price to hit your level.

Step Three: Scan through your preferred timeframes and look for the Quasimodo pattern. My preferred timeframe is the 15m but I will go as low as the 1m when I’m scalping. If you are trying out this strategy for the first time I would not recommend going any lower than the 15m timeframe.

If you look hard enough, you will find the Quasimodo pattern everywhere on the chart. Therefore, it is crucial that you only look for these patterns in high probability areas. Wait for price to reach a good area of support/ resistance before you start looking for this pattern. Once you see it, trade it just as I’ve shown you above.

Putting it all together

Now that you know what the Quasimodo pattern is, how to add it to your trading strategy and how to execute trades, let’s have a look at how to put it all together on the charts.

As mentioned above, your first step is to identify a level of support or resistance on the chart. If you don’t know how to find good areas of support/ resistance, then be on the look out for my next post where I will teach you exactly how to do that.

Once you know your levels, wait for price to hit your level, then look for the Quasimodo pattern. Here are a few diagrams on what that would look like:

Conclusion

Hopefully by now you are starting to see just how powerful this one pattern can truly be. I use the Quasimodo in nearly all of my trading set-ups. On a daily basis I will highlight zones of support and resistance and once price enters these zones I start looking for the Quasimodo pattern. If I see this pattern in my trading zone, then I trade it, if I don’t see it, then no trade.

It’s that simple. This has been the most reliable trading strategy I’ve ever come across thus far and I hope it turns out to be the same for you.

I encourage you to first train yourself to recognize and spot this pattern on your charts, and then start pairing it with your trading zones. My hope is that you can adopt this pattern, test it out, and mold it into a strategy that is your own. I’m excited to hear about what you come up with. Be sure to leave me some comments and questions below.

Thanks for reading,

Mr. E

Amazing stuff, you have a great way of showing and explaining how the market is moving and how to have a bias of where its going. Really really good.

Thank you, i now see what i have done, im just marking the first little pull back on the daily, getting too sucked into the lower time frames i think